FHA mortgage

You really need to check out a mortgage insured because of the Federal Homes Management when you yourself have a credit history out of around 500. But not, it is essential to know that loan providers can decide her credit score minimums for these form of money, and therefore you may have a more challenging date taking accepted for many who meet with the bare minimum.

What it method for the down-payment. You could build a deposit as little as step 3.5% on an enthusiastic FHA financing, but you’ll you prefer a good FICO get off 580, about. For it sort of mortgage, make an effort to generate a downpayment of at least 10% if the credit score was between five-hundred and you will 579.

Virtual assistant financing

To invest in a home playing with an excellent Va mortgage, there is absolutely no regulators-put minimal credit history. The needs are that you are an experienced, on the energetic obligations regarding the miliary, or a partner exactly who qualifies.

Having said that, loan providers out-of Va finance dictate their own minimum credit scores, paydayloanalabama.com/goshen that will will vary. Generally, however, minimal is in the mid-600s, together with mediocre credit history having Virtual assistant homebuyers try 711.

USDA loan

Like Virtual assistant loans, USDA funds don’t have a-flat lowest credit score and you may loan providers can also be dictate their own lowest rating. Rating more than 640 in your credit rating, however, can give the chance of sleek borrowing operating on this subject form of loan.

Jumbo mortgage

Good jumbo financing is for home financing to find a home that’s bigger than brand new compliant mortgage restrict. To be eligible for a good jumbo financing, loan providers generally would like you to own a credit rating significantly more than 700, this is because credit plenty cash is believed good high-risk. In fact, most loan providers will need more a powerful credit rating so you’re able to agree jumbo money. And you’re prone to have the best jumbo mortgage pricing having good FICO rating greater than 740.

To change your credit rating to purchase property, you are going to earliest need to feedback your credit history to learn why are enhance score. You should buy your own report at no cost out-of people big credit bureau. Additionally, delivering pre-approval will also will let you check your credit rating. Find out about financial pre-acceptance guidance here.

Exactly what just tend to change your credit score? Here are the most useful designs you should buy towards that may help you:

Pay their bills promptly. The payment record can make right up 35% of your own FICO credit rating. That is a major chunk, which ultimately shows you how extremely important using your costs on time is also become.

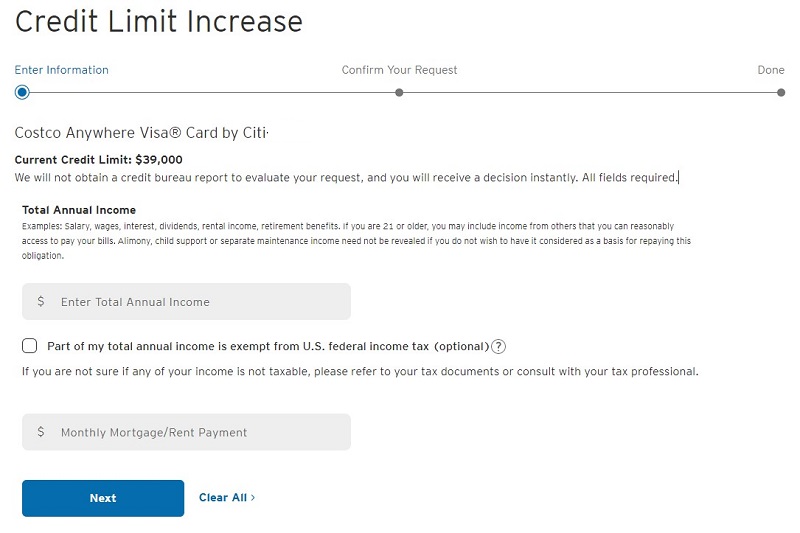

Reduce your credit application. You might decrease your borrowing utilization because of the boosting your financial obligation costs for even a short time or requesting their bank boost your credit limit.

Prevent the brand new credit lines. Your credit score shall be adversely impacted to have 6 months in the event that too many difficult borrowing issues are performed for new lines out of borrowing from the bank. Therefore-end the credit lines.

Continue dated account discover. In lieu of closing dated profile, remain old credit lines discover in order to catch up with the earlier in the day delinquencies otherwise payments.

Explore patience. Do the work, wait it out. The reason perseverance is really important would be the fact it could take around 6 months and then make significant transform on borrowing rating.

Remember: it can take a while to change your credit score to purchase a home-it won’t occurs straight away. not, the benefits try tall whenever you are browsing purchase a good property. Even shorter credit history advancements will certainly reduce the pace your discover, possibly helping you save tens and thousands of dollars over the lifestyle of loan. Assembled, you to results in a serious savings that’ll eventually pay for your retirement otherwise the infant’s expenses.