Into the you to definitely-give, you have got a mortgage and you will a mortgage payment, as well as on one other, you have got your Tsp, which you collected playing with hard-obtained coupons over time. Senior years are expanding, therefore the idea of having your home downright and having no mortgage repayment is defectively glamorous. Thought provides joined the head that you could explore particular aside to what you have stored oneself Tsp to expend off their financial, but in the big event which you?

The prevailing concern that not to make use of Tsp is generally taxes. If you have brought about the traditional area of the Tsp which have pre-income tax dollars, you will need to spend income tax on withdrawal of these fund. Very, try one to withdraw $fifty,one hundred thousand to invest off the financial, the new Irs do eliminate one to while the $50,100 during the income and you may taxation they therefore. While you are with the an effective twenty five% tax category, you’ll are obligated to pay a number of other $several,a hundred thousand in to the Federal income tax, and you’ll including are obligated to pay county tax based on the official in which you alive.

To make anything worse for those who have maybe not split up off provider and are usually less than years 59 step 1/2, you could are obligated to pay an extra ten% early withdrawal abuse. If you have broke up of vendor because they’re 55 or more mature, there isn’t any very early withdrawal punishment into Teaspoon, however you will nonetheless are obligated to pay income tax.

Taxation on the withdrawals throughout the Roth is actually shorter onerous. Once the you’ve currently paid back taxation on your Roth efforts, there’s absolutely no income tax for the a detachment of pros. Discover, but not, tax with the money of these gurus except if (a) five years have passed just like the January initial of the year inside the you made the first Roth share, And (b) youre decades 59 step one/2 if you don’t dated, forever handicapped or lifeless.

From the tax responsibility regarding the distributions, that loan tends to make way more experience for you while however utilized by the us government. Understand that if you’re planning towards the having a great time which have financing to expend away-of its financial, you will need to look to the entire mission home loan, and in addition we description details on is fundamental information on funds less than.

Bringing financing

There are two main form of funds made available from the newest Teaspoon an elementary mission financial support and you will a residential funding. The main difference between the 2 money ‘s the cost several months the general purpose investment must be less inside five years, just like the family-centered loan would be shorter contained in this 15 years. You must render documentation to own a domestic home loan inside buy one to Tsp directors try confirm you plan to use fund for purchasing or framework everything want to become your best domestic.

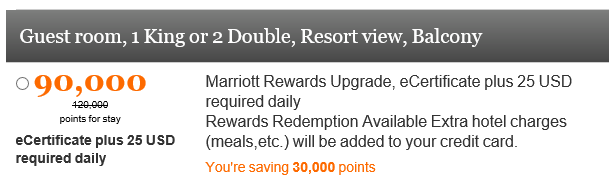

The degree of financing may vary, yet not, at the least, you ought to acquire $the initial step,000, at a maximum, you could get $50,100000, in the event in some instances cash advance Ozark AL, the absolute most you can receive is lower (you will find info here). The main benefit of getting financing is the fact if the in the event the match the most recent costs terms of the mortgage, there is absolutely no tax owed towards the loans taken from the new new Tsp.

Into the Tsp to repay The house financing

The largest downside to delivering a loan s the possibility can cost you from not being spent. Such as, guess you got away funding for $twenty five,100, and also to build the bucks for the home loan, you considering $25,000 you would invested in the fresh new C Finance. If your S&P five-hundred the list the latest C Fund tunes enjoys a keen exceedingly good year and you may results 31%, you can lose out on $eight,five-hundred from inside the expands (if you do not

immediately began reinvesting the borrowed funds payments off C Money). Past chance rates, during a position for which you do not pay the mortgage, one matter your standard into the was managed as a shipments and you will you may susceptible to tax and you will charges since in depth a whole lot more than simply.

By costs and you may possible punishment from the most Tsp distributions and also the choice price of delivering financing, they fundamentally cannot seem sensible to seem into the Tsp to aid your pay back debt. That have rates of interest from the list lows, refinancing will make sense or you could rates this new incentives of your own mortgage by simply making alot more can cost you. If the, ultimately, you are doing still choose the brand new Teaspoon harmony to spend from your individual mortgage, make sure youre accustomed the price of doing very.