If there is something that somebody usually have trouble with whenever these are generally to order a residential property into the Nyc, it’s the money.

Taking accepted to own a home loan is not effortless, which is why there are a lot apps which might be designed to help individuals get the money needed getting an New york home.

Whilst you may a good Virtual assistant financing without a down-payment, civilians cannot usage of that type of financing when you need it.

Rescuing up to own a downpayment isn’t always possible, specifically if you need to upgrade your household otherwise purchase an effective huge capital domestic into the urban area restrictions.

- A connection mortgage is a kind of mortgage that assists “bridge” new gap ranging from investing. It’s useful for manufacturers who want to pick a unique home right away however, whoever funds was fastened with regards to home purchases, which are in the business not sold.

- It loan are a short-title financing, likely to be paid out of to the selling of your household.

- A bridge loan is a great means to fix place money off and you can cover settlement costs, but not, they may be able provides high charge and you will rates of financing.

- Some regular requirements so you’re able to be eligible for a link mortgage are having sophisticated borrowing and you may having no less than 20% guarantee in your home. Being in a sexy market is also an advantage.

- If the taking a bridge loan isn’t really simple for you, you can look at taking an excellent HELOC or getting a special type from mortgage.

What is actually a bridge Financing?

A bridge loan is a kind of loan you to acts as temporary capital for a buy, when you are individuals secure extended-title resource.

From the a house world, connection financing are acclimatized to get a deposit ready to the another type of home as they loose time waiting for their particular home to be sold.

Alternatively, they have been quick-identity finance that will be expected to be distributed off if the brand spanking new residence is offered from. otherwise within a-year of buying the domestic.

Why must Anyone Have fun with A bridge Loan?

- Providing you an approach to get an advance payment and security settlement costs. Here is the huge draw for many individuals, but it is well worth citing that there are other ways to help you make this happen.

- Taking recognition is fast, that produces to buy a property quicker. Punctual approvals make this a large mark for all those in the beautiful locations. Talking about and that…

- Many suppliers will require a buyer that a connection loan more a purchaser whom doesn’t. While the link funds generally make certain you have some sort of money (or at least ways to pay bills unless you do), might take that it given that an indicator your more knowledgeable of financial support the home than just a person who cannot.

What are the Downsides Having A bridge Financing?

The 3 most significant factors people have which have bridge financing are the high-rates, brand new higher charges, and also the quick lending words.

When Do A link Financing Seem sensible?

Knowing the rewards while the downfalls of utilizing connection loans shows an appealing photo with regards to funds.

It will become clear one by using these money tends to merely create feel when you find yourself looking to buy a home inside the a high-request field, learn you reside going to sell, and need to maneuver Today.

As they are reported to be pricey and you may quite high-risk, many financial advisors would suggest to avoid him or her ideally.

Yet not, when you really need the true house package discover pushed as a result of rapidly, they are able to generate lots of experience.

Just how Common Is actually Link Fund?

Though the notion of a bridge loan you may prove to be used in a lot of people, the reality is that it isn’t precisely a consistent point to help you find in most housing areas.

How can Connection Funds Really works?

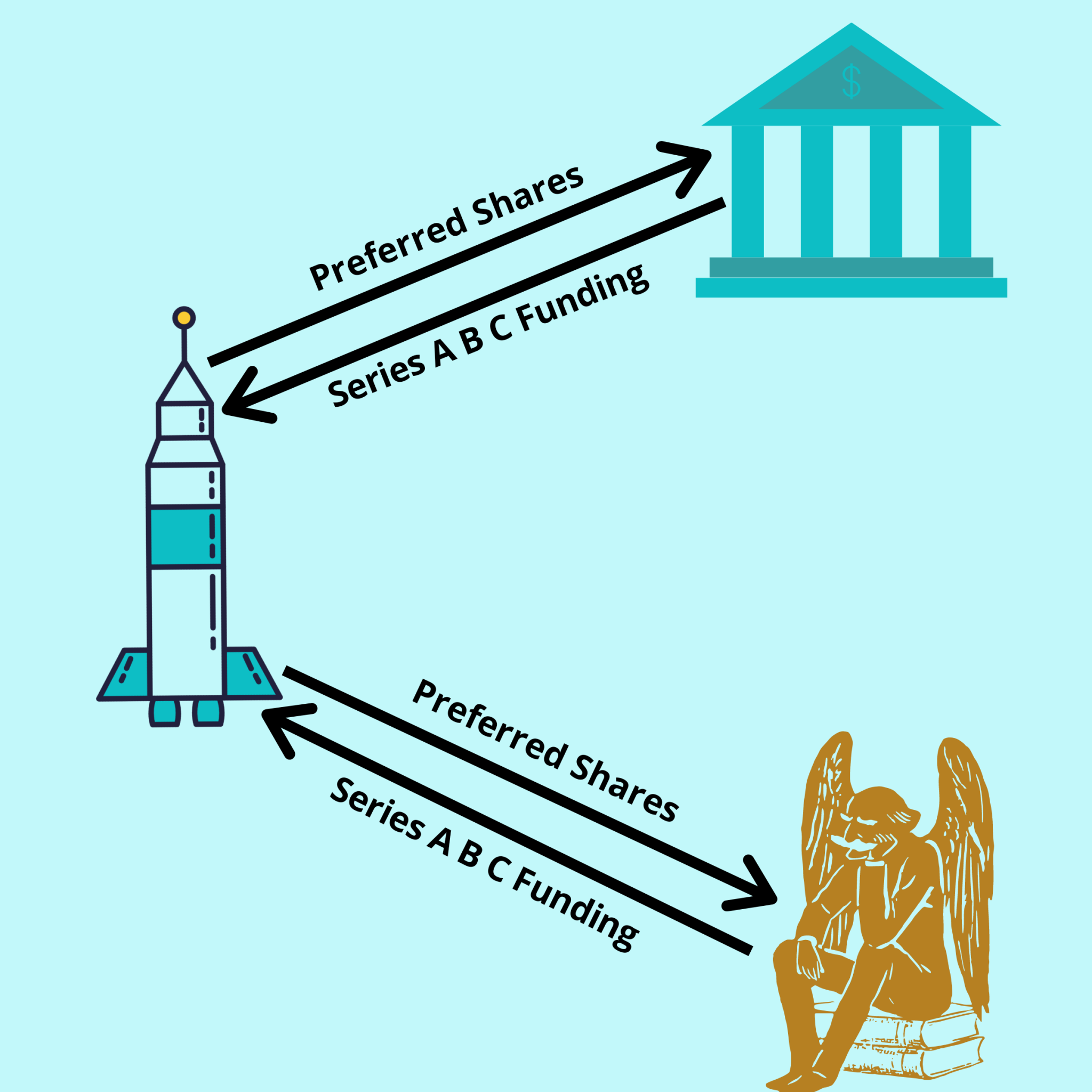

Receive a connection loan, you’ll normally have to make use of your home’s guarantee just like the power. Bridge money payday loan companies in Coleytown are usually included in one of two means:

- The brand new bridge loan can be used to pay-off their brand new home and give you extra cash having a deposit for the a different family. So it disposes of the debt while having lets you availability your home’s collateral having a downpayment that works well together with your budget. In the event that modern residence is marketed, you only pay off the traces of the bridge financing.

Discover more about your other costs to shut by training Just how so you’re able to Determine Closing costs during the Ny: Helpful information To possess Buyers.

What happens If your Household Deals Drops As a result of?

When this occurs, you will be responsible for both the home loan as well as the link loan. This leads to a standard or other extreme stress.

Can i Qualify for A connection Mortgage?

This is a hard matter. No matter if the lenders get their own requirements, there are some general guidance which they have a tendency to realize.

If you aren’t convinced your residence was marketed, you shouldn’t strive for a bridge financing. It may effortlessly backfire.

While having problems qualifying as you need to raise your credit rating, see Just how to Replace your Credit rating discover Accepted.